Probability is a difficult concept to grasp.

Few people tend to understand it on a theoretical level, with the exception being people with college degrees in applied math, statistics, computer science, engineering, physics and some finance programs.

Among these, even fewer tend to understand the real-world implications of the mathematical theories.

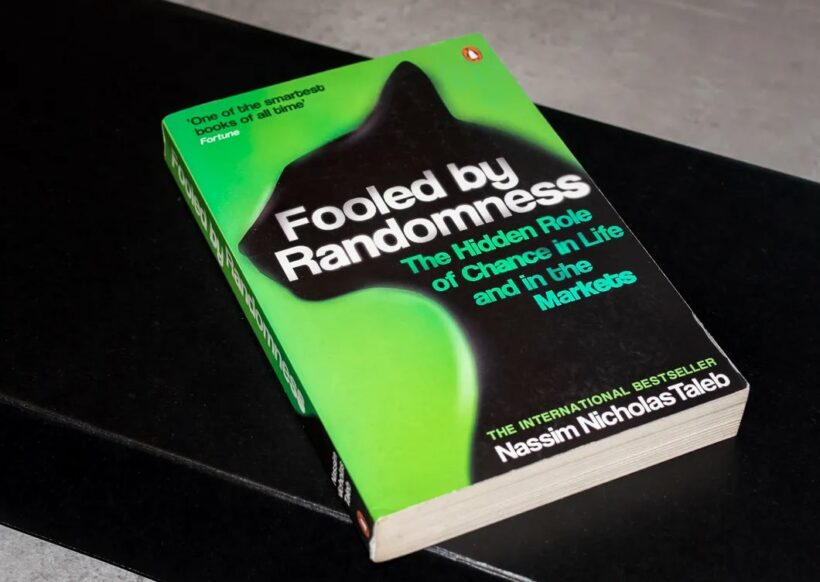

In Fooled by Randomness, the best-selling author and professional trader, Nassim Taleb, takes a stab at this and attempts to explain how a world dominated by randomness have us fooled in many situations.

One field in which people tend to be extra vulnerable of being misled, happens to be the financial markets.

Let’s dive in and continue to read Top 5 Takeaways (summary) for Investors from the book, Fooled by Randomness.

1. Survivorship Bias

Consider this scenario:

John is a 22 year old and he has already amassed a fortune of 3 million dollars. Are you impressed by John?

One might be, until you realize how he got his fortune. He got it through playing Russian Roulette with the Mafia on three occasions. Each wager was for 1 million dollars.

Sure, he might be the lucky owner of 3 million dollars today, but in 42% of other possible realities, he died before his 23rd birthday!

Now of course, this is not a problem – John may do whatever he likes with his life!

Problems start to arise when John explains for other young people how they easily can gain 3 million dollars in their early 20s just play some Russian Roulette!

It’s not as dangerous as it seems. The trick is to blink three times as hard as you can and then make a clap, before pulling the trigger. Trust me. It’s “bulletproof”.

John the Russian Roulette player

This is a clear case of survivorship bias.

Youth all over the world may admire John for his Russian Roulette skills and try his strategy in the game themselves thinking that it’s “bulletproof”.

Consider another situation:

Martin the monkey is throwing darts on the stock listings of the OMXS30 index, which is an index of the 30 largest companies listed on the Swedish Stock Exchange. He did this on January the 1st of

2018 to pick 3 companies.

In 2018 his return is 12%, which is a handsome profit considering that the OMXS30 is down by about 10% this year (2018).

Martin is very proud of his returns, and he tells all his monkey friends about his brilliant strategy of picking stocks through dart throwing.

He informs them about which velocity to use, how to add an advantageous spin, and even what kind of food they should have the day before the throwing!

The problem is that neither we as investors, nor Martin himself, consider the other possible outcomes of Martin using this approach.

What if he instead of hitting Ericsson with his first arrow had hit SKF? Then his return would have been -12% instead of +12%.

The issue is that, because of survivorship bias, we will never hear about the Martins who missed Ericsson for an SKF.

The highest-performing realization will always be the most visible.

- The book “How I lost 12% investing in a market that declined 10%” will never make it to the bookstore shelves.

- However, “How I made 12% in a market that declined 10%” might become the next best seller.

When picking three stocks from the OMXS30 index, the expected return was about minus 10% for 2018 (in hindsight, that is).

The standard deviation was 11%, which implies that, out of 40 monkeys, one would have had the same return as Martin, or even better!

Let’s pretend that there are 2,000 monkeys out there.

Then 50 of them would have had a return of 12% or better, by pure chance!

And one of them will definitely write a book about it.

2. The Skewness Issue

During his time as a trader at a large investment house in New York, Nassim Taleb once found himself in a meeting with company stakeholders, where they wanted his opinion on the stock market.

He told them that he thought the market is likely to go up during the coming week.

He said that it’s probably a 70% chance that the market will rise.

Someone interrupted: “But Mr. Taleb, I just saw you taking a huge short position in S&P 500 futures. What what made you change your mind?”

Taleb explained that nothing made him change his mind. That he had a lot of faith in his bet of shorting the market.

A faint laugh went through the room.

The guy who asked about the shorting of S&P 500 futures seemed utterly confused. “Mr. Taleb, I don’t understand. Are you bullish or are you bearish?”

Talib explained that he didn’t understand the question. Sure, he was bullish, if bullish means which direction he thought the market would go, but it was still preferable to short the market because In the case of the market going down, Taleb expected a much larger move in that direction.

People in general confuse probability and expectation, which is probability times payoff.

Consider this stock:

- It has a 90% chance of going down 10% and

- it has a 10% chance of going up 200%.

Would you buy it? Well, you should want to buy it! On average, such a stock will yield 11% on your capital!

A lot of people are not comfortable taking bets of this kind in the real world, where the underlying probabilities aren’t as clearly defined as in our theoretical example.

Why?

Because it hurts a lot being wrong in 90% of the cases.

Even the occasional huge wins don’t make up for it.

In his trading approach, Nassim Taleb loves to take advantage of this “skewness issue”.

One of his main strategies, is to bleed some, frequently, but to make sure that he never experiences a cutthroat loss, and that every winning bet is a homerun.

3. The Black Swan Problem

Most probably you heard of The Black Swan problem.

What do you think about following statement? Is it true or false?

“The stock market (as in the Dow Jones Industrial Average) has never been down more than 23% during one single day during is approximately 44,000 days of existence. Therefore, it can’t go down more than 23% in a day.”

Of course, this statement is false.

Imagine someone making a similar argumentation on the 18th of October in 1987.

“The stock market can’t go down more than 30% during a single day because it has never done so during its 33,000 days of existence.”

This person will be proven wrong the next day, when the Dow Jones Industrial Average crashed by 22.6%.

This is referred to as the Black Swan problem.

No amount of observation of white swans can allow the inference that all swans are white, but the observation of a single black swan is sufficient to refute that conclusion.

Always be careful when relying on statements such as “the market has never done this before” in your investing approach.

4. Pascal’s Wager

Always expecting that you can’t learn from historically great investors or traders, because of survivorship bias, and because there might be a black swan lurking around the corner, presents a very pessimistic view of the investing profession. to counter this, Nassim Taleb presents the classic Pascal’s Wager.

According to the philosopher Pascal, the optimal strategy for humans is to believe in God and his existence.

For IF God exists, the believer will be rewarded, and if he doesn’t exist, the believer has nothing to lose.

You can reason like Pascal did in your trading or investing approach.

If historical data shows that a given strategy is successful, you should use that to your advantage.

For IF the historical data reveals opportunities for the future, you will be rewarded, and if it doesn’t reveal anything at all, you’ll probably return the market average anyways.

But Don’t use historical data to decide your risk exposure.

This way, you’ll get the potential benefits of a strategy that you’ve noticed to be successful in the past while you avoid the risk of overestimating its accuracy.

5. The 5 Traits of The Market Fool

According to Nassim Taleb, the market fool has a tendency to do the following:

- Overestimating the accuracy of his beliefs in an economical or statistical measure. Being overconfident about historical data, is dangerous for many reasons. Black Swans, the reliability of the data, the fact that the market might have changed, and data fitting are some of them.

- Getting married to his positions. There is a saying that traders divorce spouses before positions. Don’t be that guy.

- Changing the story. He becomes a long-term investor all of a sudden when he is losing money on his positions. After all, he doesn’t want to sell now, when it’s even better “value”. He never considers that his way of determining value might be what’s wrong.

- He has no plan for how to take losses. Because he doesn’t think that he can lose money when taking a trade, he doesn’t have a game plan for how to react in the event of this happening. ALWAYS predefined your risk.

- He is in denial. Once he finally accepts his losses, which is way too late, by the way, he refuses to believe that it was his own fault. He was simply “unlucky”. What’s funny is that when he earns money (remember Martin the Monkey from takeaway number one) he attributes it all to skills.

In the eyes of the market fool, losses always happen due to randomness, while profits always come thanks to skills.

Our recap

In essence, “Fooled by Randomness” by Nassim Taleb encourages readers to be more humble in their understanding of the world.

The book hints us to be aware of the limitations of our ability to predict and control events. It advocates for a more nuanced and skeptical approach to decision-making, particularly in areas where randomness plays a significant role.

Fooled by Randomness is rich with insights, anecdotes, and thought-provoking ideas that encourage readers to reevaluate their understanding of success, failure, and the role of chance in their lives.

Some of the points in this book:

- One must be careful when judging a person’s performance based on their results. We must also consider that there were alternative outcomes, that didn’t occur. Otherwise, we’ll be victims of the survivorship bias.

- Don’t confuse probability and expectancy. When we are investing, we want to maximize our profit expectancy, not our profit probability.

- Beware. We’ve probably not seen the worst yet, a Black Swan might be lurking around the corner.

- Use historical data and back-testing to decide on your investing approach, but be careful about letting it decide your risk exposure.

- Avoid overconfidence, getting married to positions, changing your story, investing without an exit plan, and denying the fact that luck and randomness plays a role in both profits and losses.

Quotes from Fooled by Randomness book (Nassim Nicholas Taleb)

“The writer Umberto Eco belongs to that small class of scholars who are encyclopedic, insightful, and nondull. He is the owner of a large personal library (containing thirty thousand books), and separates visitors into two categories: those who react with ‘Wow! Signore professore dottore Eco, what a library you have! How many of these books have you read?’ and the others – a very small minority – who get the point that a private library is not an ego-boosting appendage but a research tool. Read books are far less valuable than unread ones.”

“Reality is far more vicious than Russian roulette. First, it delivers the fatal bullet rather infrequently, like a revolver that would have hundreds, even thousands of chambers instead of six. After a few dozen tries, one forgets about the existence of a bullet, under a numbing false sense of security. Second, unlike a well-defined precise game like Russian roulette, where the risks are visible to anyone capable of multiplying and dividing by six, one does not observe the barrel of reality. One is capable of unwittingly playing Russian roulette – and calling it by some alternative “low risk” game.”

“Traders lack critical thinking skills. The general practitioner can reason better than the social scientist. The difference is in the rigor and method in medicine, which constrain the effects of the physician’s psychological flaws. Traders are like geriatric physicians who do not have to worry about malpractice suits.”

“The problem with experts is that they do not know what they do not know.”

“The problem with a survivor is that he is an expert in just one thing: surviving. And just surviving is not sufficient to solve complex problems.”

“The fragile wants tranquility, the antifragile grows from disorder, and the robust doesn’t care too much.”

“We humans, facing limits of knowledge, and things we do not observe, the unseen and the unknown, resolve the tension by squeezing life and the world into crisp commoditized ideas, reductive categories, specific vocabularies, and prepackaged narratives, which, on the occasion, has explosive consequences.”

Nassim Taleb, Fooled by Randomness

These quotes offer a glimpse into the thought-provoking and often contrarian ideas presented in “Fooled by Randomness.” The book is filled with many more insightful observations and reflections on randomness, uncertainty, and decision-making.